As Ontario’s iGaming market grows, the cybersecurity expectations for operators are increasing. The Alcohol and Gaming Commission of Ontario (AGCO) requires all licensed iGaming operators to follow strict cybersecurity rules. In this article, we outline what iGaming operators in Ontario need to know about AGCO’s cybersecurity regulations. We will pay special attention to MFA requirements, best practices for implementation, and how to remain compliant in 2025 and beyond.

1. AGCO Cybersecurity Requirements: An Overview

The Ontario Alcohol and Gaming Commission (AGCO) mandates strict cybersecurity standards in its Registrar’s Standards for Internet Gaming to be implemented by all Internet gaming licensees from licensed online casinos and sportsbooks. The standards aim to protect the integrity, security, and fairness of Ontario iGaming business. Key requirements include:

- Secure Authentication – operators must implement strong access controls to prevent unauthorized access to player data and internal systems.

- Access Management – only authorized staff should have access to sensitive systems based on job requirement and function.

- Data Protection – all sensitive data must be encrypted both in transit and at rest.

- System and Network Security – operators must use firewalls, anti-malware tools, and intrusion detection systems to protect their infrastructure.

- Ongoing Risk Assessments – regular evaluations must be conducted to identify and address cybersecurity risks.

- Incident Response and Recovery – there must be provisions for discovery, response, and recovery from cyber security incidents.

- Logging and Monitoring – systems log activity and access, with monitoring to detect suspicious behavior.

- Third-Party Security – third-party integrations and services must comply with the same level of security.

While not all control is specified at a level of technical specifics, AGCO does expect that operators take a risk-based approach and apply security controls commensurate with the sensitivity of information and systems. MFA would be a central control in that context, and especially for protecting privileged access and sensitive user data.

| Requirement Area | Checklist Items |

|---|---|

| Access Control |

|

| Secure Authentication |

|

| Data Protection |

|

| System & Network Security |

|

| Risk Management |

|

| Logging & Monitoring |

|

| Incident Response |

|

| Third-Party Security |

|

| Audit & Documentation |

|

2. Multi-Factor Authentication in AGCO Standards

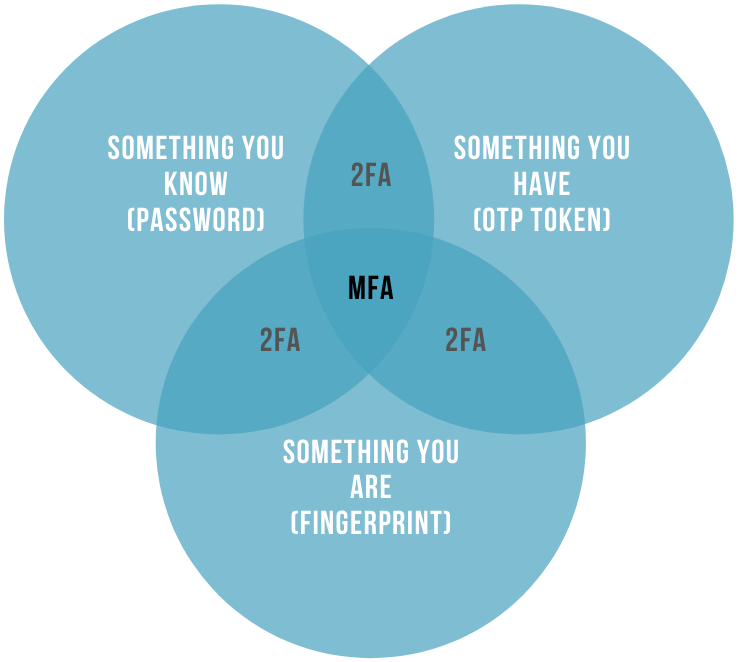

The AGCO’s cybersecurity framework highlights secure authentication as a critical control, with Multi-Factor Authentication (MFA) playing a key role. Here’s how MFA fits into the standards:

MFA for Player Accounts

- Not mandatory, but strongly recommended.

- Operators must offer MFA as an optional feature to players.

- Players should be informed about the security benefits of enabling MFA.

- This helps reduce risks from weak passwords and account takeovers.

MFA for Internal and Privileged Access

- MFA is effectively required for all staff and third parties with elevated access.

- Licable to supplier integrations, backend infrastructure, payment systems, and administrative portals.

- Ensures only authorized users can access sensitive systems.

Risk-Based Approach (Standard 7.4)

- Security controls must match the risk level associated with the data or system.

- High-risk areas (e.g., players’ data, financial transactions, administrators’ accounts) require strong protection like multi-factor auth.

- Operators must evaluate risks regularly and adjust authentication accordingly.

MFA is a core part of AGCO’s cybersecurity expectations, even if not explicitly mandated for all users. Offering MFA to players and enforcing it for privileged users aligns with best practices and regulatory guidance. Implementing MFA supports compliance with AGCO’s broader access management and data protection requirements.

3. Best Practices for Integrating 2FA in Ontario iGaming

To comply with Ontario Liquor and Gaming Control Commission regulations and reduce the risk of violations, online gaming operators should develop a thoughtful and flexible strategy for implementing multi-factor authentication (MFA). It is important to ensure that all critical access points are secured without creating disruption to users or reducing operational efficiency.

Protect High-Risk Access Points First

Start by enforcing MFA for:

- Admin and back-office portals

- Payment processing systems

- Customer support interfaces

- Third-party and vendor logins

These areas typically involve sensitive data or elevated permissions and are a clear focus of AGCO audits.

Offer MFA to Players in a User-Friendly Way

- Make MFA optional but highly visible in account settings.

- Use clear messaging to explain the benefits.

- Support convenient MFA options like authenticator apps (Protectimus SMART, Google Authenticator, and similar), chatbots in messaging apps, or push notifications.

The easier it is for players to adopt MFA, the more effective it becomes as a security layer.

Support Multiple MFA Methods

- TOTP (Time-Based One-Time Passwords) using apps like Protectimus Smart

- Using chatbots in messaging apps to deliver one-time passwords

- Hardware tokens for high-security scenarios

- Email or SMS authentication (if allowed, but should be secondary to stronger methods)

- Push-based authentication for a seamless experience

Ensure Compliance with Logging and Auditing

- Record successful and failed authentication attempts

- Monitor for abnormal access patterns

- Store logs securely and retain them for audit purposes

Plan for Scalability and Integration

- Choose an MFA solution that integrates easily with your existing infrastructure (cloud or on-premise)

- Ensure compatibility with common protocols like RADIUS, SAML, and LDAP

- MFA should work across web portals, mobile apps, and internal systems

4. Choosing the Right MFA Solution for AGCO Compliance

Selecting the right MFA solution is critical to achieving AGCO compliance without compromising usability or operational efficiency. Not all MFA providers offer the flexibility, integration options, or level of control needed for a regulated iGaming environment.

Key factors to consider:

- Support for AGCO-compliant authentication methods. Look for a solution that supports a wide range of methods: TOTP apps, push notifications, hardware tokens, and optional SMS/email codes.

- Easy integration with existing infrastructure. The MFA system should integrate seamlessly with your iGaming platform, back-office tools, VPNs, and admin portals via protocols like RADIUS, LDAP, and SAML.

- Scalability and performance. As your player base and internal teams grow, the MFA solution must scale easily without downtime or added complexity.

- Cloud or on-premise deployment options. Operators may prefer on-premise deployment for greater control and data residency compliance, or a secure cloud version for faster setup.

- Centralized management and logging. The solution should offer detailed logs, analytics, and configuration options to support audit readiness and ongoing security monitoring.

5. Why Protectimus MFA Is the Smart Choice for Ontario iGaming Operators

For entrepreneurs in iGaming who desire to meet AGCO cybersecurity requirements efficiently and reliably, Protectimus MFA offers a flexible, secure, and compliant service that is designed specifically in line with the requirements of regulated businesses.

Built for Compliance

Protectimus supports all MFA methods expected by AGCO, including:

- TOTP (via apps like Protectimus Smart or third-party authenticators)

- Push authentication

- Hardware tokens

- SMS and email as backup options

- Integration with messaging platforms (e.g., Telegram, Viber) for OTP delivery

Easy Integration

Protectimus integrates with any platform using standard protocols such as RADIUS, LDAP, and API/SDK options. Whether you operate on-premises or in the cloud, our solution fits your infrastructure with minimal effort.

Full Control: Cloud or On-Premise

Choose between cloud-based deployment for speed and convenience, or on-premise installation for full control over data and compliance with internal or regulatory policies.

Trusted and Proven

Protectimus is trusted by clients in finance, government, healthcare, and iGaming — wherever strong authentication and compliance matter most.

Protect Your Platform – and Your Players

Don’t let security gaps put your license or reputation at risk. With Protectimus, you can offer players strong account protection and secure your internal systems — all while staying fully aligned with AGCO cybersecurity standards.

Contact us today to learn how Protectimus MFA can help your iGaming platform meet AGCO requirements quickly and effectively.

Read also

- 5 Steps to Prepare your Business for Multifactor Authentication

- 6 MFA Myths You Still Believe

- Top 5 Two-Factor Authentication Products by Protectimus

- On-Premise 2FA vs Cloud-Based Authentication

- TOTP Algorithm Explained

- The Pros and Cons of Different Two-Factor Authentication Types and Methods

Subscribe To Our Newsletter

Join our mailing list to receive the latest news and updates from our team.

Subscribe To Our Newsletter

Join our mailing list to receive the latest news and updates from Protectimus blog.

You have successfully subscribed!